wake county nc sales tax rate 2019

Monroe NC Sales Tax Rate. Average Sales Tax With Local.

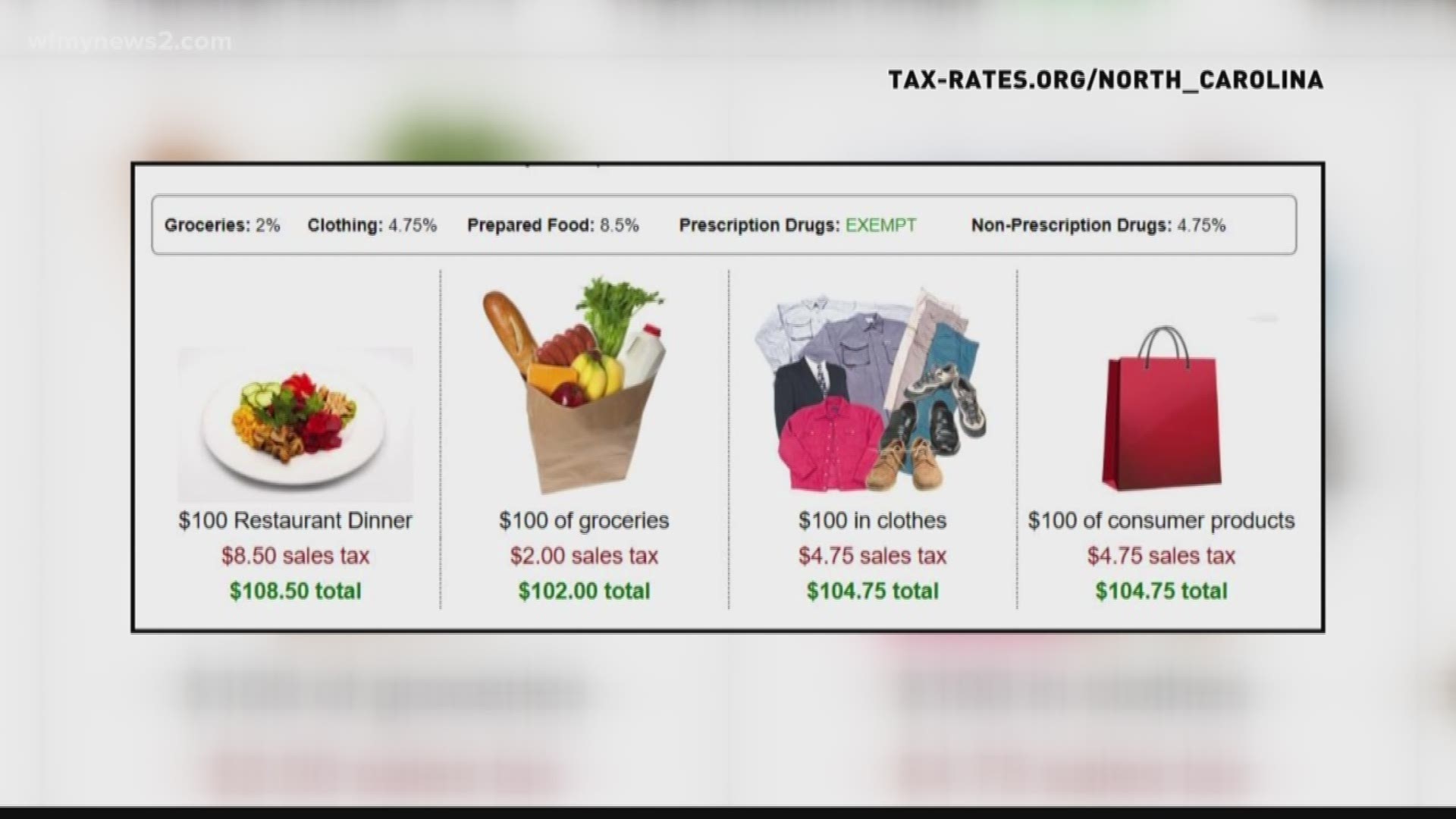

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Rocky Mount NC Sales Tax Rate.

. The Wake County Sales Tax is collected by the. The change was largely due to a 1 percent sales tax in Broward County and a 15. NC 69 2 SC3 GA 129 19 FL0 22 AL 91 5 S0 21 TN 9.

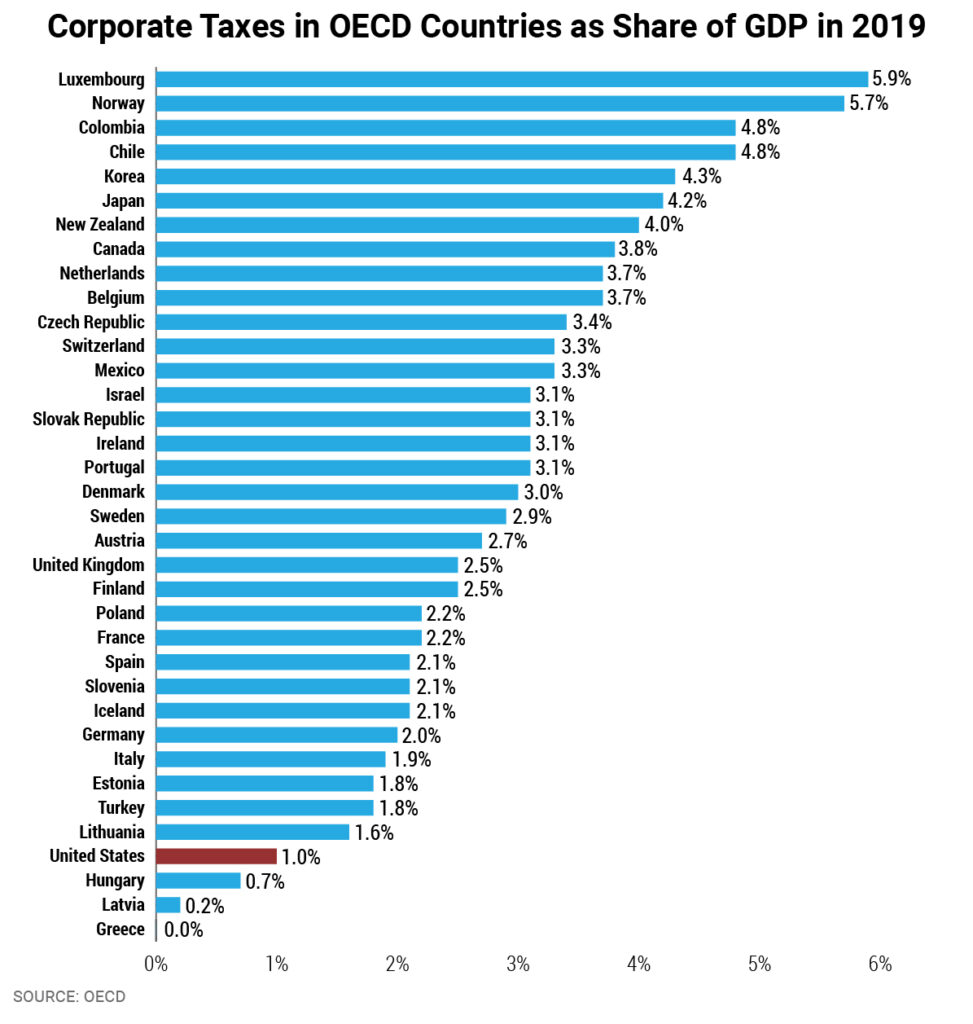

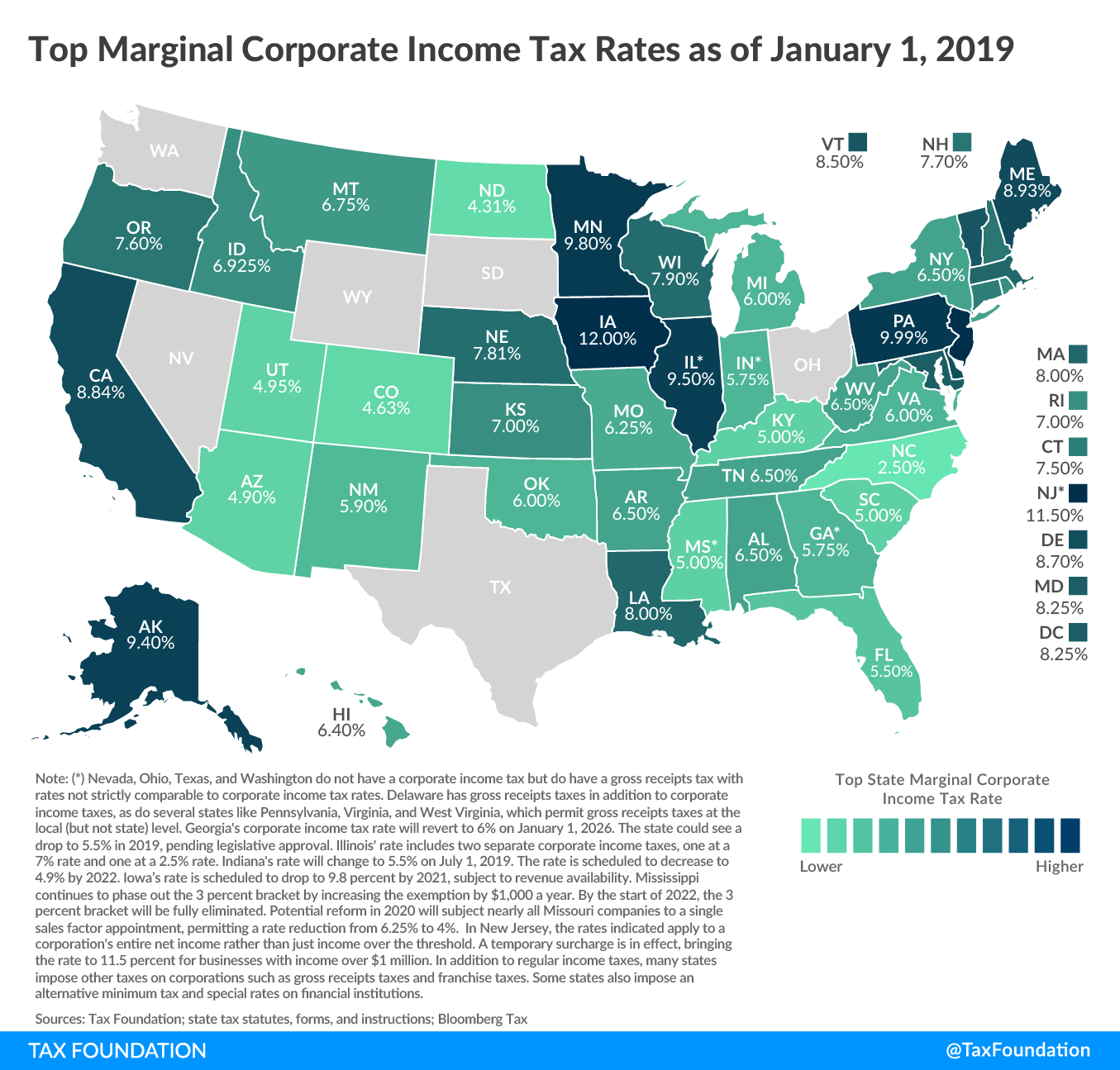

252 745-4125 Land Records. There is not a local corporate income tax. 1 K 600 3 OH1 20 IN00 23 IL.

The new Wake County property tax rate. 7 MO13 1 AR 93 3 LA. The North Carolina state sales tax rate is currently.

Wake County leaders voted for the measure 6-1 to adopt the 147 billion budget for 2019-2020. Local Tax Rate a Combined Rate Combined Rank Max Local. Has impacted many state nexus laws and sales tax collection requirements.

The December 2020 total local sales. Sales and Use Tax Rates Effective April 1 2019 NCDOR. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

California 1 Utah 125 and Virginia 1. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Appointments are recommended and walk-ins are first come first serve.

Box 538 Bayboro NC. These rates are weighted by population to compute an average local tax rate. A motor vehicle with a value of 8500.

Wake Forest NC Sales Tax Rate. 800 am - 500 pm Monday - Friday Address. The corporate income tax rate for North Carolina is 40.

The 2018 United States Supreme Court decision in South Dakota v. Residents of Wake County have an average effective property tax rate of 088 and the median annual property tax payment is 2327. Fortunately North Carolinas property taxes are generally fairly low.

Four citiesTampa Florida and Bakersfield Chula Vista and Riverside Californiasaw sales tax rate increases of 1 percent or more in the first half of 2019. State Local Sales Tax Rates As of July 1 2019 a City county and municipal rates vary. Raleigh NC Sales Tax Rate.

Wake County collects on average 081 of a propertys assessed fair market value as property tax. Physical Location 301 S. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

West Raleigh NC Sales Tax Rate. The Wake County Sales Tax is 2. Wake County NC Sales Tax Rate.

New Bern NC Sales Tax Rate. A single-family home with a value of 200000. The minimum combined 2022 sales tax rate for Mecklenburg County North Carolina is 725.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. Research demonstrates a rise in cross-border shopping and other avoidance efforts as sales tax rates increase. For more information or to determine if any special district taxes or fire district taxes apply to your specific location please visit the Wake County Revenue Department website.

Salisbury NC Sales Tax Rate. The corporate income tax rate for North Carolina will drop to 30 starting. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

There are a total of 460 local tax jurisdictions across the state collecting an average local tax of 222. To review the rules in North Carolina visit our state-by-state guide. 3800 Raleigh NC 27601.

The current total local sales tax rate in Wake County NC is 7250. B Three states levy mandatory statewide local add-on sales taxes at the state level. A county-wide sales tax rate of 2 is applicable to localities in Wake County in addition to the 475 North Carolina sales tax.

We include these in their state sales tax. Box 2331 Raleigh NC 27602. The base state sales tax rate in North Carolina is 475.

Sales tax in Wake County North Carolina is currently 725. Tax rates are applied against each 100 in value to calculate taxes due. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in order.

The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake County North Carolina Sales Tax Comparison Calculator for 202223. Kannapolis NC Sales Tax Rate. 252 745-4042 Office Hours.

You can find more tax rates and allowances for Wake County and. The property is located in the City of Raleigh but not a Fire or Special District. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg.

County rate 6195 Raleigh rate 3930 Combined Rate 10125 Recycling Fee 20. The most populous location in Wake County North Carolina is Raleigh. Pamlico County Courthouse 202 Main Street PO.

35 rows County Rate County Rate County Rate. North Carolinas second most populous county will see the new measure take effect on July 1. If you own a home in Wake County North Carolina paying property taxes isnt something you can avoid.

This is the total of state and county sales tax rates. If this rate has been updated locally please contact us and we will update the sales. A full list of these can be found below.

Tax Administration Hours MondayFriday 830 am515 pm. Some cities and local governments in Wake County collect additional local sales taxes which can be as high as 075. The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300.

The average cumulative sales tax rate between all of them is 725. Wake County is located in North Carolina and contains around 14 cities towns and other locations. Mooresville NC Sales Tax Rate.

The Wake County sales tax rate is. The Mecklenburg County sales tax rate is 2. The North Carolina state sales tax rate is currently 475.

Find your North Carolina combined state and local tax rate. As for zip codes there are around 60 of them.

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Morrisville North Carolina S Sales Tax Rate Is 7 5

Property Taxes By State Embrace Higher Property Taxes

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

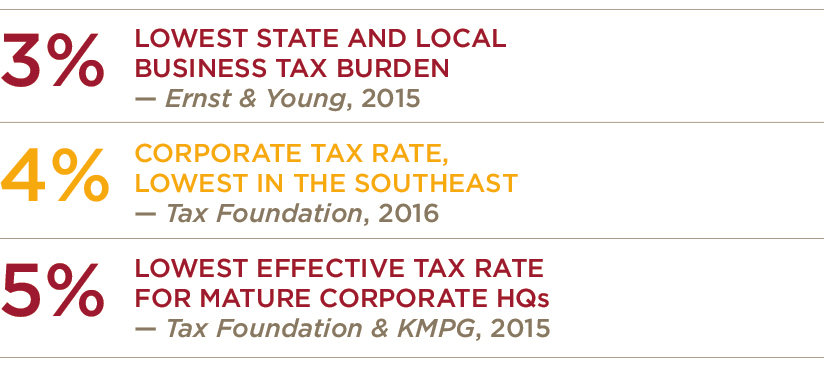

Taxes Cary Economic Development

Taxes Wake County Economic Development

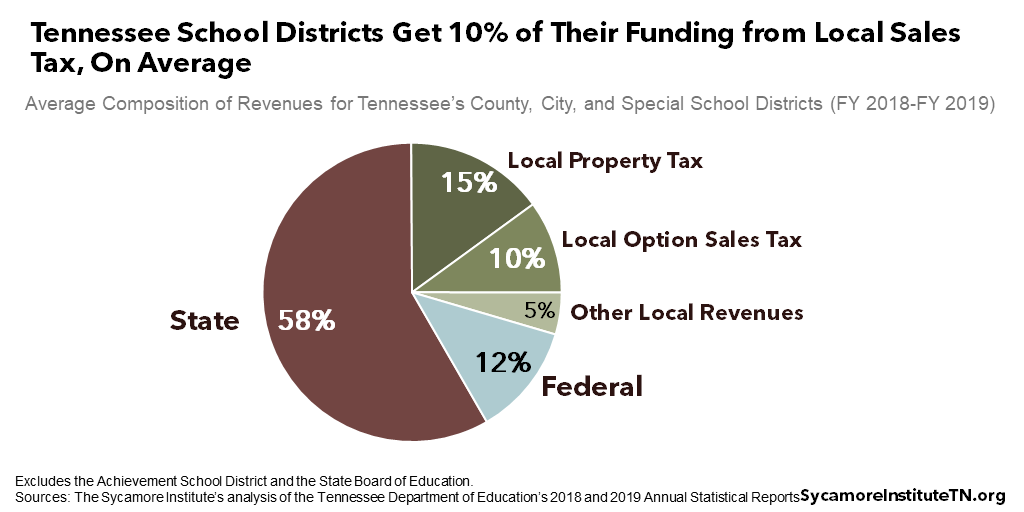

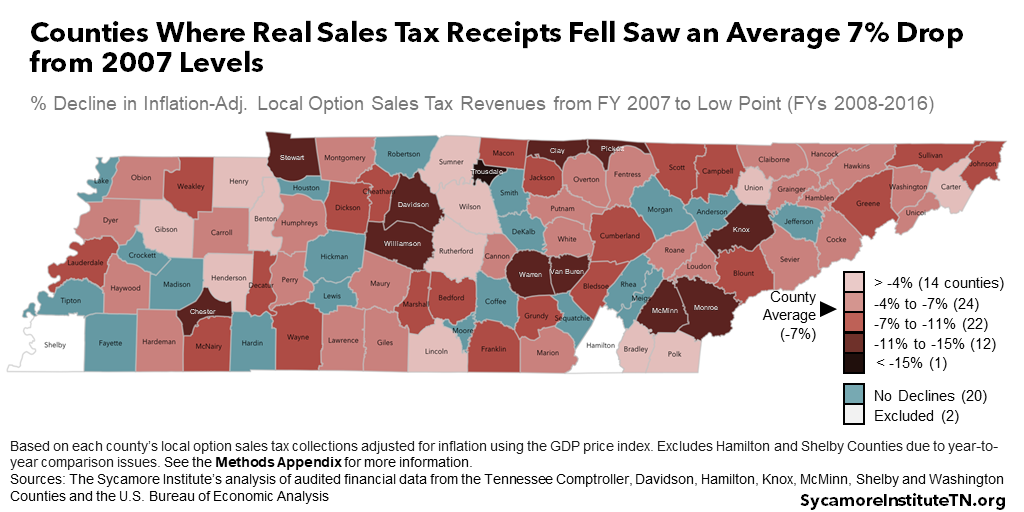

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Taxes Cary Economic Development

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue